Today Koei Tecmo announced its financial results for the first half of the fiscal year, related to the period between April and September 2024. The company provided interesting insight into its plans and business.

The presentation slides reveal that sales were 35,197 million yen, down 11.4% year-on-year. Operating Profit was 10,651 million yen, down 23.1% year-on-year.

Interestingly, profits are actually higher than expected by 2,651 million yen due to the fact that sales of games released in previous fiscal years including Rise of the Ronin have exceeded expectations.

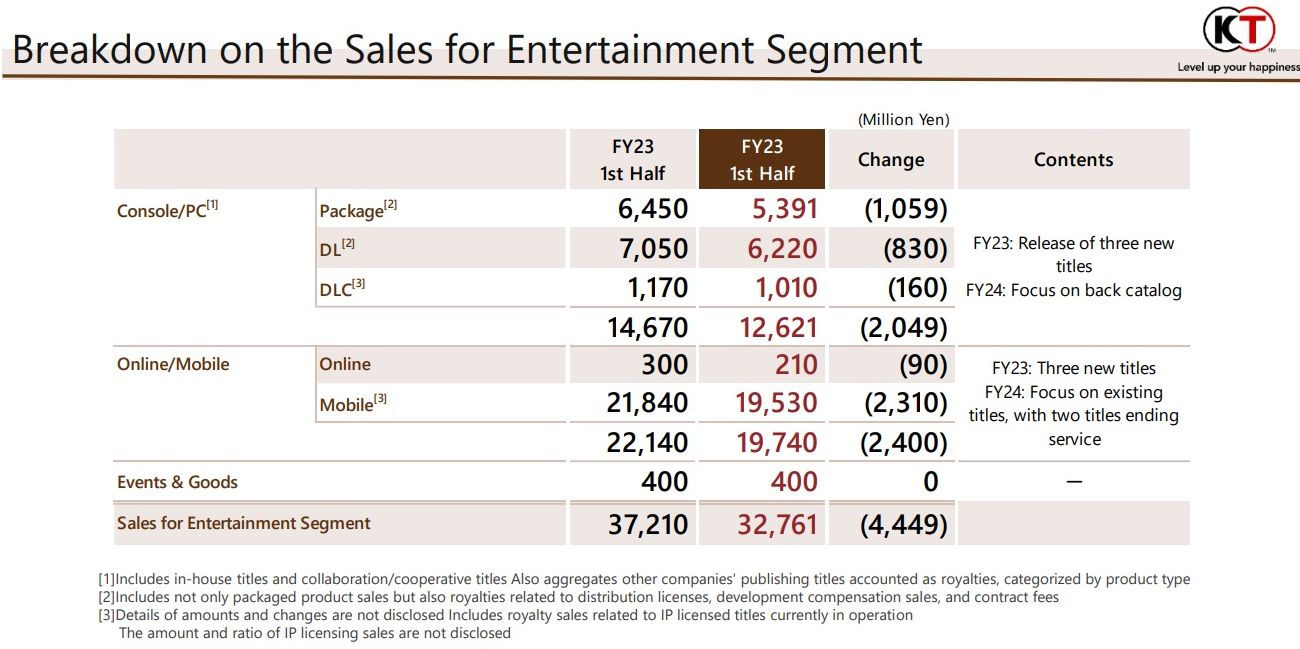

Looking at the Entertainment segment of the business (which includes games) specifically, sales were 32,761 million yen, 4,449 million yen less compared to the same period last year. Operating profit was 10,371 million yen, 3,281 million yen less compared to the same period last year.

This is due to an overall decrease in sales of games across both PC/consoles and Online/mobile.

Interestingly, sales in Japan and Asia decreased year-on-year, while sales in North America and Europe increased. Below you can find a breakdown by platform families and product category. Numbers between parenthesis indicate a drop year-on-year.

Koei Tecmo’s earnings forecast for the full fiscal year remains unchanged, albeit it achieved only 39.1% of its forecasted sales and 35.5% of its forecasted profits. Most of the releases for the year are focused in the second half.

Interestingly, the company appears to have more bolts in its quiver as “several unannounced titles (up to mid-tier) are scheduled for release within the fiscal year.”

Looking at its 3rd Mid-Term Management Plan, which spanned the period between 2022 and 2024 and will end this fiscal year, the company pretty much missed its target of generating 40 billion yen in profits a year. The forecast for this year is 30 million yen. It intends to re-challenge this target with the 4th Mid-Term Management Plan, which will start in April 2025.

It achieved 2 new IPs that sold over 5 million copies, and 4 games that achieved over 2 million copies.

The target of releasing a smartphone game capable of generating 2 billion yen in sales a month has been missed but KT will continue to try. 2 Games managed to achieve 1 billion yen in monthly sales.

At the moment, Koei Tecmo is ranked 14th in the world among gaming companies worldwide in terms of operating profit (according to the company’s own research). This is up from 17th in 2022. The next target is to increase operating profit by 10% each fiscal year and reach the top 10 in the world.

The plan to achieve that is to “consistently launch large-scale titles every year and create titles across diverse genres” and self-publish KT’s own titles even when they’re large. This is interesting, as it may signal a change in direction from letting Sony publish large games like Rise of the Ronin.

The ultimate vision remains to become the number one digital entertainment company in the world. This will require success in AAA titles, new genres and new IPs, and building a structure enabling the consistent creation of large-scale hit titles in-house.

Koei Tecmo already has “many” games already in development for the next medium-term plan period, and the overall portfolio is expected to be on par with the current period, which had 2 AA-class games, 4 large-class games, and about 15 up to mid-tier.

The company recognizes that creating new IPs is essential for the group’s medium- to long-term growth, and it needs to continue to take on challenges, even for smaller titles.

Interestingly, we hear that the proprietary Katana Engine is being improved including “High-Speed Processing Technology and Lighting Technology” for the next fiscal year.

That being said, it will continue using a third-party engine on a title-by-title basis. This fiscal year, processes to improve the quality of PC games have been established and are already operative.

If you’d like to compare, you can check out the financial results for the previous quarter, announced in July.